A non-resident individual is taxed at a flat rate of 30 on total taxable income. Personal income tax rates.

Does Denmark Need Yet Another Tax Reform Ecoscope

In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively.

. Income Tax Withholding Tables 2019. EPF Rate variation introduced. 2013 2500 2014 2500 2015 2400 2016 2400 2017 2400 2018 2400 2019 2400 2020 2400.

A company will be a Malaysian tax resident if at any time during the basis year the management and. Income Tax Rate Table 2018 Malaysia. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

Resetting number of children to 0 upon changing from married to single status. Malaysian Income Tax Rate 2018 Table. Rates of tax 1.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with. What are the income tax rates in Malaysia in 2017-2018.

Similarly those with a chargeable. On the First 5000. Income tax rate Malaysia 2018 vs 2017.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Income Tax Rates and Thresholds Annual Tax Rate. A resident company incorporated in Malaysia with an ordinary paid-up share capital of RM25 million and belowor.

Taxed under the Malaysian Income Tax Act 1967 MITA are taxed under the Labuan Business Activity Tax Act 1990 at 3 of audited net profits or may elect a fixed tax of MYR 20000. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. Malaysia has a fairly complicated progressive tax system.

Taxplanning budget 2018 wish list audit tax accountancy in johor bahru comparing tax rates across asean malaysian tax issues for expats. Malaysia Non-Residents Income Tax Tables in 2019. Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85 info tax exemptions malaysia 2019.

50 income tax exemption on rental income of residential homes. Malaysia Corporate Tax Rate 2018 Table. Assessment Year 2018-2019 Chargeable Income.

Whats people lookup in this blog. 20182019 Malaysian Tax Booklet 18 b there was no material omission or. Whats people lookup in this blog.

Calculations RM Rate TaxRM. Home Uncategorized Malaysia Corporate Tax Rate 2018 Table. On the First 2500.

Malaysian Income Tax Rate 2018. Companies incorporated in Malaysia with paid-up capital of MYR 25 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first MYR 500000 with the balance. Reduction of certain individual income tax rates.

The Simple PCB calculator takes into account of RM2000 special tax relief limit that capped at income RM8000mth. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. The corporate tax rate is.

The amount of tax relief 2018 is determined according to governments graduated scale. Masuzi December 15 2018 Uncategorized Leave a comment 7 Views. Income Tax Rate Table 2018 Malaysia.

Corporate companies are taxed at the rate of 24. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3. Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets.

Theres a lower limit of earnings under which no tax is charged - and then a progressively higher tax rate is applied. Malaysia Personal Income Tax Rate. Calculations RM Rate TaxRM 0-2500.

Tax Relief Year 2018. Transfer pricing is regulated by the provisions of Section 140A of the Malaysian Income Tax Act. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Retakaful It is proposed that the income tax rate of all reinsurance and retakaful Insurancebusiness should be standardised at a single rate of 8. 2 Subject to subsections 3 and 4 where a person in the basis period for a year of.

The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Tax Rate Table 2018 Malaysia.

20182019 Malaysian Tax Booklet Income Tax. This overview of the Malaysian income tax system is a great starting point. 01 Feb 2016.

But tax is a complex legal area. Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Budget 2019 Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan.

In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA 2017 and 2018. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

The 2018 budget would provide a 50 income tax exemption on rental income earned by Malaysian resident individuals effective from YA 2018 to 2020. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the. Monthly Tax Deduction 2018 for Malaysia Tax Residents optionname00 Allowance Bonus0000.

Income attributable to a Labuan business.

Pin On Gst Accounting Software Services

Do You Need To File A Tax Return In 2018

Do You Need To File A Tax Return In 2018

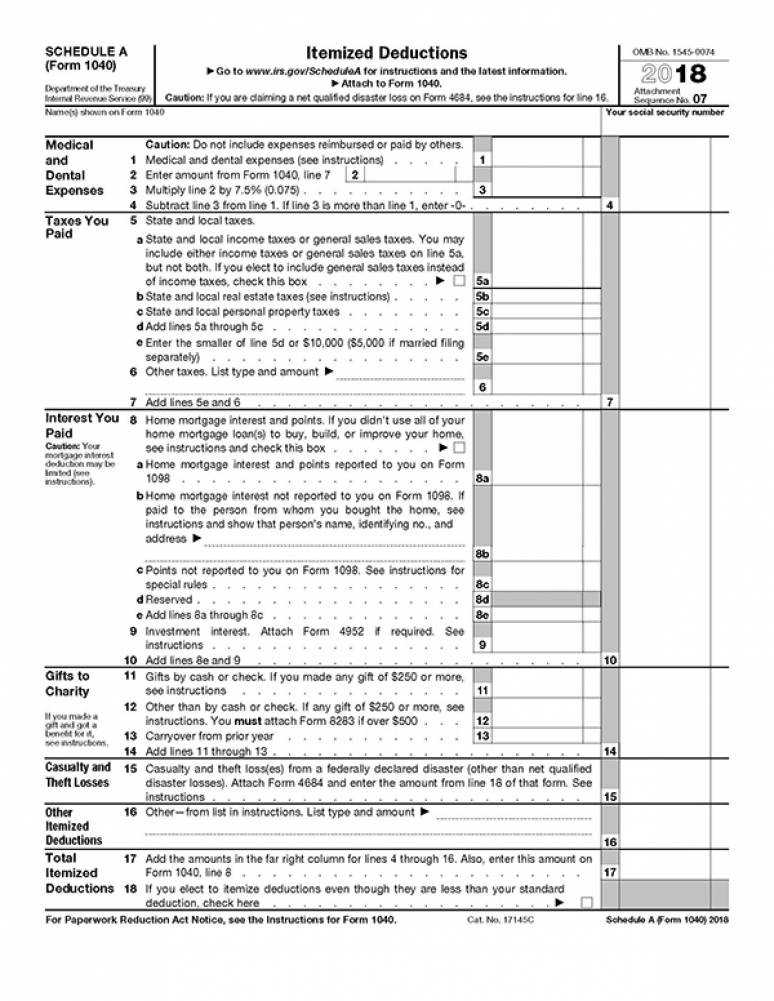

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Doing Business In The United States Federal Tax Issues Pwc

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Slab Tax Rates For Ay 2018 19 Fy 2017 18 Income Tax Return Income Tax Tax Exemption

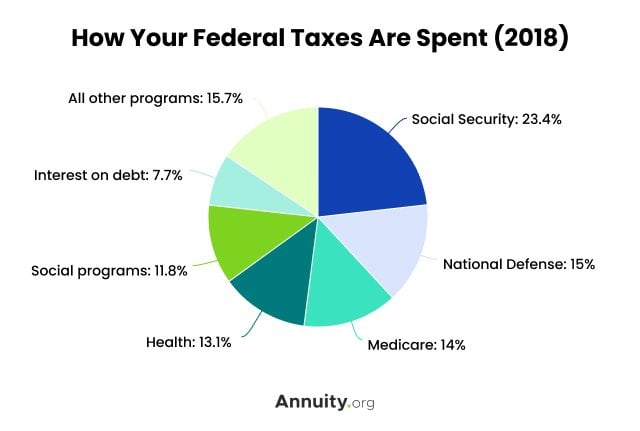

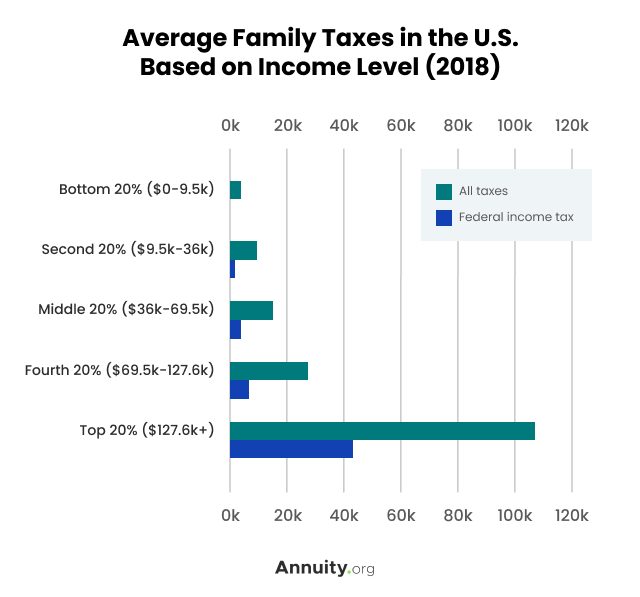

Tax Information What Are Taxes How Are They Used

Tax Information What Are Taxes How Are They Used

Airbnb Guide To Investment Locations In Malaysia Property Investor Malaysia Investment Property

10 Things To Know For Filing Income Tax In 2019 Mypf My

The Purpose And History Of Income Taxes St Louis Fed

Income Tax Malaysia 2018 Mypf My

From Today Wednesday 5 Apri South African Motorists Will Pay 24 Cents Less Per Litre Of Petrol And 11 Cents Less For Dies Petrol Price Fuel Prices Fuel Cost